South Korean police say that Do Kwon, the fugitive cryptocurrency boss who caused the $40 billion (£32.5 billion) crash of the terraUSD and Luna tokens, has been caught in Montenegro.

Since then, prosecutors in the US have said that he lied.

US regulators said earlier this year that Do Kwon and his company Terraform Labs “ran a multi-billion dollar crypto asset securities fraud.”

When the BBC asked the company what they thought, they didn’t say anything right away.

Last September, South Korean authorities issued a warrant for Mr. Kwon’s arrest because they thought Terraform Labs had broken the rules about the capital market.

They thought he was in Serbia, and because there was no extradition agreement between the two countries, they sent people there to talk.

Do Kwon has said that he was not hiding in the past, but he has never said where he was.

The first person to say that he had been caught was the interior minister of Montenegro, Filip Adzic. He wrote on Twitter that “one of the most wanted criminals in the world” had been caught at the airport in Podgorica.

Mr. Adzic also said the suspect is thought to have traveled using a fake name and papers. However, he said that the police were waiting to find out who the man was officially.

Friday, South Korean police confirmed that Do Kwon was the suspect in Montenegro. They did this by comparing his fingerprints to official records.

US prosecutors brought fraud charges against Do Kwon

The US District Court in Manhattan released an indictment against him on Thursday. It says he is guilty of securities fraud, wire fraud, commodities fraud, and conspiracy. When the BBC asked Mr. Kwon’s lawyer for a comment, the lawyer didn’t answer right away.

Montenegro has no deals with the US or South Korea to send criminals to those countries.

In February, US financial regulators said that Mr. Kwon and Singapore-based Terraform Labs “failed to provide the public with full, fair, and truthful disclosure as required for a number of crypto asset securities, most notably for Luna and TerraUSD.”

They lied to investors about how stable TerraUSD was and kept saying that the value of the tokens would go up.

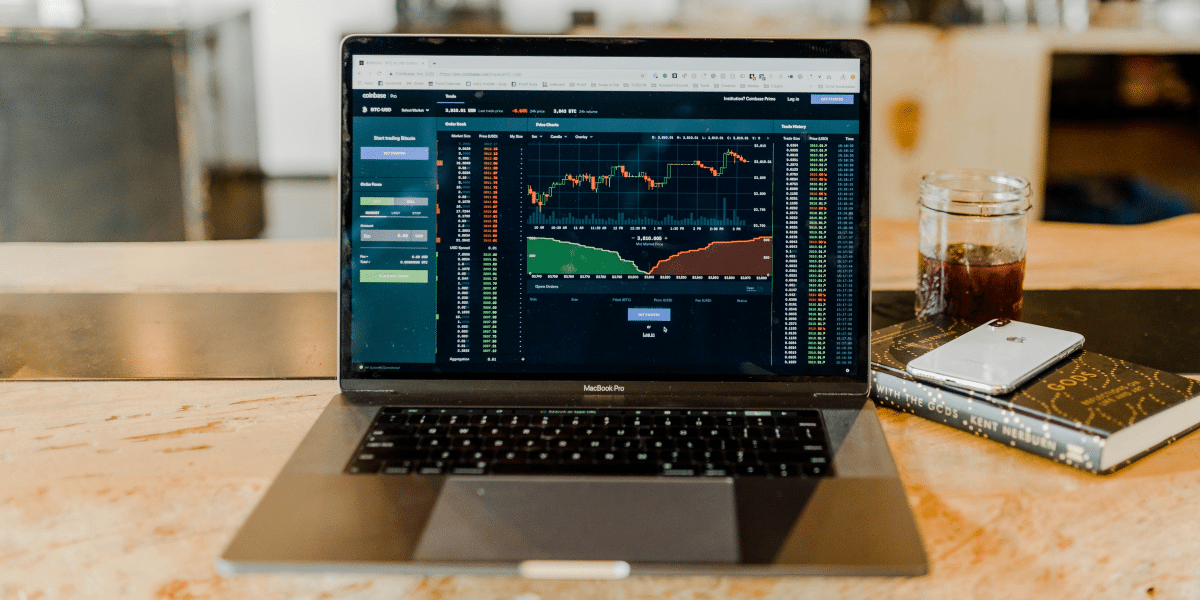

But in May of last year, the value of the token and the Luna cryptocurrency it was linked to dropped to almost nothing.

It dropped the prices of major cryptocurrencies like Bitcoin, Ethereum, and Tether. Because of this, the word “cryptocrash” started to be used a lot on the internet.

A blockchain analytics company called Elliptic says that people who invested in TerraUSD and Luna lost about $42bn worldwide.

At the time, Do Kwon was probably in Singapore, which does not have a deal with South Korea to send criminals there.

In a recent interview on the crypto show Coinage, Do Kwon said that deciding whether to return to South Korea was hard for him.

He also said that he had yet to talk to the police.

The Financial Times reported that prosecutors plan to arrest and extradite Mr. Kwon from Singapore by taking away his passport and working with Interpol.

SEC charged the boss of “Cryptocrash” with fraud

US financial regulators have said that failed South Korean cryptocurrency boss Do Kwon and his company Terraform Labs “orchestrated a multi-billion dollar crypto asset securities fraud.”

Last year, the Terra Luna and TerraUSD tokens, which a company made in Singapore, crashed in a big way.

People think that investors lost more than $40 billion (£33.5 billion) due to the crash.

Mr. Kwon and Terraform Labs waited for the BBC to reply with their thoughts.

The SEC says that Do Kwon and his company made billions of dollars from investors by selling them “an interconnected suite of crypto asset securities.” But, unfortunately, a lot of these deals had to be written down.

The SEC also said that Mr. Kwon and Terraform repeatedly said that the value of the tokens would go up and lied to investors about how stable TerraUSD was.

But in May of last year, the value of the token and the Luna cryptocurrency it was linked to dropped to almost nothing.

A blockchain analytics company called Elliptic says that investors in TerraUSD and Luna lost about $42bn worldwide.

It dropped the prices of major cryptocurrencies like Bitcoin, Ethereum, and Tether. Because of this, the word “cryptocrash” started to be used a lot on the internet.

Read Also: US accuses Guo Wengui of billion-dollar fraud

Other things were said in the SEC complaint, but it didn’t say where Mr. Kwon was.

Even though they had a warrant out for Mr. Kwon’s arrest, South Korean authorities said in December that they thought he was in Serbia.

Do Kwon said before that he wasn’t hiding but didn’t say where he was.