Image commercially licensed from: Unsplash

In order to purchase a typical house in eight U.S. cities, prospective homeowners must now earn $200,000 or more, according to new research. Homeownership prices continue to push away all but the wealthiest buyers.

In the past year, the average mortgage payment in the US has increased by 45.6%. Homebuyers must pay more merely to stay up with escalating financing expenses, per a recent research by real estate platform Redfin, with interest rates for 30-year fixed-rate mortgages hovering around 7%.

According to Redfin, as of October, a homeowner in the U.S. needs to make an average of $107,281 per year to afford the typical $2,682 monthly mortgage payment. This is an increase from $73,668 in the previous year.

Why Are Homes Currently So Expensive?

Even right now, home values are rising. You should start asking yourself this question, “what’s the lowest credit score to buy a house?” as soon as possible, of course, if you are considering taking out a loan. According to NY Rent Own Sell data, housing prices have increased by 15% over the last 12 months. The current high cost of homes is only due to the supply and demand issue.

In order to strengthen the economy after the COVID-19 epidemic, interest rates were lowered. Demand surged as a result of the sharp decline in borrowing rates and the desire of many Americans to move away from cities and apartments in favor of more affordable residential locations.

In contrast, a lot of vendors left the market as a result of political and economic unrest. Since then, more buyers than sellers have joined the housing market, significantly driving home prices.

To Purchase the Typical Home, Homebuyers in 45 Large Metro Areas Must Earn at Least $100,000

The greatest income requirements for homebuyers are found in San Francisco and San Jose, followed by Anaheim, CA, where the average buyer needs to make $254,286 in order to afford the regular mortgage payment of $6,357 (+42.1% YoY), so money borrowing app is not a good option for borrowing large sums in this case. The top five are completed by Los Angeles and Oakland ($221,592, up 40.7%).

In about half (45) of the metro areas analyzed, homebuyers must make at least $100,000 per year to purchase a property. It’s an increase from the 16 metros a year earlier. In 2022, as mortgage rates increased at their quickest rate in history, hitting 7% by the end of October, the income necessary to purchase a home surged.

Detroit has the lowest income requirements in the region, but the typical house price ($48,435) is still more than it was a year ago. It is followed by Pittsburgh ($57,853, up 41.7%), Rochester, NY ($56,508, up 56.2%), Cleveland ($53,817), Dayton, OH ($51,126, up 46.1%), and Pittsburgh ($57,853 up 41.7%).

Smaller-than-average rises were also seen in the Bay Area, although a significant amount of money is still required to purchase there. To afford the median $10,071 monthly mortgage payment in San Francisco, buyers now need to make $402,821 per year, a 33.6% increase.

Oakland ($247,559) and San Jose ($363,265, both up 36.1%) are next in line. Because they are among the few regions of the nation where home values are declining year over year, the gains are lower in Lake County and the Bay Area than in other areas.

Home of the American Dream

The typical home price in the country was $368,200, while the national annual fixed mortgage rate was 4%. According to this, the typical national household income is over $9,000 below the wage required to buy a home, which is almost $76,000.

But what type of houses are people interested in buying? The kind of residence and available square footage may vary greatly depending on where you live.

Only about 4,000 single-family detached homes in the classic sense are ever listed for sale in New York City, for instance. In the Big Apple, people frequently purchase condos or multi-family homes.

Additionally, even seven figures in larger cities won’t get you much if you’re searching for luxury. Only 833 square feet of premium real estate in Miami may be purchased for a million dollars. In order to afford the $2,682 monthly mortgage payment on the median U.S. home, a buyer must make at least $107,281 annually, a 45.6% increase from the $73,668 required a year earlier.

Source: Redfin

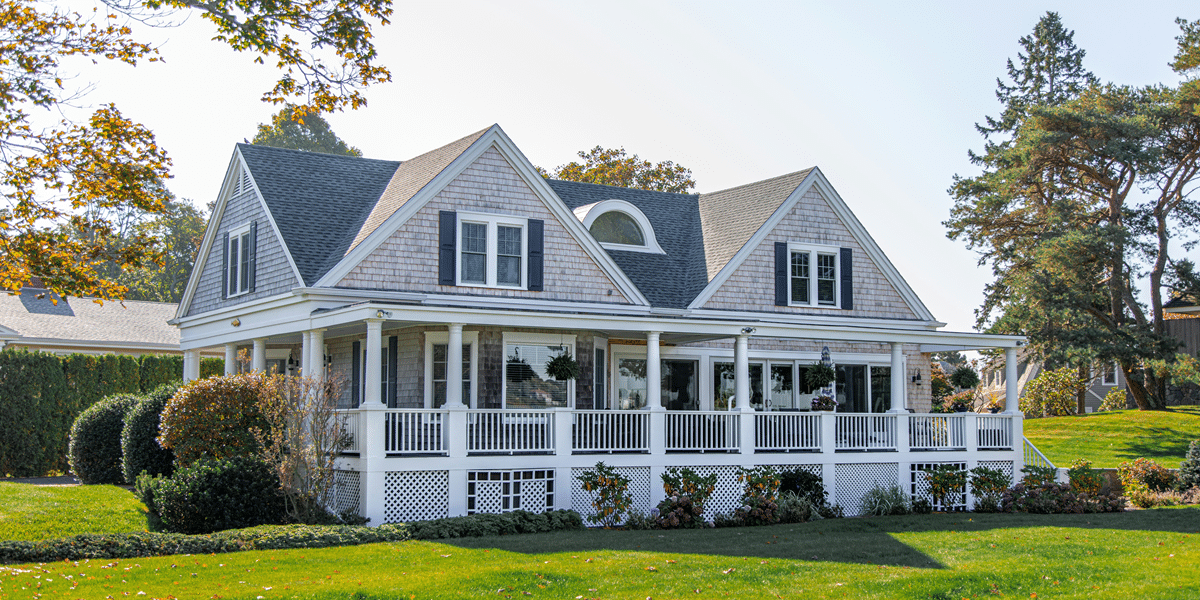

One thing is certain: smaller metro centers with roomy suburbs make the conventional American dream home—a huge house with a yard and white picket fence—more feasible.

Mortgage DTI Conditions

The type of loan you receive, the length of the loan, the interest rate, and the down payment all affect how much money you’ll need. Your overall DTI must be under 45%, and your housing-related DTI must be under 36% to qualify for a mortgage.

Your total mortgage debt must be 31% or less of your gross income if you want to use an FHA-backed loan. Over 43% of your gross income cannot be owed in debt.

Monthly Salary

You’ll probably only need to present current W-2s and pay stubs if you’re employed. You must provide your tax returns and any other papers the lender requires if you are self-employed.

Suppose you recently transitioned into a higher-paying position. In that case, you might want to wait a year or two before applying for a mortgage, depending on the property price you’re going for. Your lender could be more inclined to give you more money the longer you remain in your higher-paying work. When lenders determine your income, they consider more than simply your pay.

Your lender will determine the exact sources of revenue outside your salary. However, the most crucial aspect is that the revenue you disclose is reliable. For instance, your lender is unlikely to take into account your alimony arrangement if it specifies that you would only receive payments for one year.

Conclusion

The median house prices and mortgage payments are based on Redfin sales data for October 2021 and October 2022, respectively. Mortgage rates are calculated using the 3.1% and 6.9% average interest rates for October 2021 and October 2022, respectively.