Are you a parent going through a separation or divorce? Coincidentally, you’ve come to the right place. In this article, we will explore the essential requirements and impact of binding child support agreements. We aim to provide you with the precise and analytical information you need to navigate this complex area of family law.

First and foremost, a binding child support arrangement must be in writing and include independent legal advice for both parties involved. The agreement should clearly outline the amount of child support payments and require a minimum of 35% care by the receiving parent.

Once in place, certain obligations arise for both parents and changes in circumstances or care arrangements can affect the agreement.

Stay tuned for an in-depth exploration of these crucial topics.

Key Takeaways

- Binding child support agreements must be in writing and require independent legal advice for both parties.

- The amount of child support payments must be clearly outlined in the agreement, and it requires a minimum of 35% care by the receiving parent.

- Parents with binding agreements must fulfill their financial responsibilities, provide accurate information about care arrangements, and pay child support in full and on time.

- Changes in care arrangements or circumstances may affect the agreement’s validity, and it is important to seek legal advice and establish a new agreement if necessary.

Requirements for Binding Child Support Agreements

You must have a written agreement with independent legal advice to meet the requirements for a binding child support agreement. This means both parents must seek legal advice and obtain legal certificates to ensure the agreement is fair and legally binding.

Additionally, there must be an agreement on the amount of child support payments, and the receiving parent must meet a 35% care requirement.

It’s important for both parents to understand their obligations under the agreement fully. The paying parent must pay child support in full and on time, provide information about care arrangements for the children, lodge tax returns on time, accurately report income, and notify about any changes in circumstances.

It’s also important to note that changes in care arrangements or circumstances may affect the agreement, and there’s a possibility to end the agreement if it no longer supports these changes.

Obligations for Parents With Binding Agreements

As a parent with a binding child support agreement, you must fulfill your financial responsibilities and provide accurate information about care arrangements for your children.

Paying child support in full and on time is crucial, ensuring that your financial obligations are met.

Additionally, you must provide accurate and up-to-date information about the care arrangements for your children, as this information is essential for determining the appropriate amount of child support.

It’s also important to lodge your tax return on time and accurately report your income, as this information is used to calculate child support payments.

Furthermore, you must notify the relevant authorities about any changes in your circumstances that may affect the child support agreement.

Changes and Termination of Binding Agreements

If changes in care arrangements or circumstances arise, it’s important to be aware that they may impact the validity of your binding child support agreement.

Any changes that affect the care arrangements for your children, such as a significant increase or decrease in the amount of time they spend with each parent, could invalidate the agreement.

It’s crucial to notify the other parent and seek legal advice to address these changes and determine how they’ll affect the agreement.

Sometimes, it may be necessary to terminate the existing agreement and establish a new one that reflects the updated circumstances.

It’s important to understand the implications and seek legal guidance to ensure compliance with the requirements of the child support system.

Getting a Child Support Assessment

A child support assessment is required for a lump sum binding agreement, and other types of binding agreements are optional. This assessment determines the amount of child support that the non-residential parent should pay to the residential parent.

It takes into account factors such as the income of both parents, the number of children, and the care arrangements in place. The assessment is conducted by the Child Support Agency and provides an objective calculation of the child support amount.

It’s important to note that even if a binding agreement is in place, the agency can still issue a child support assessment. This ensures that the child’s best interests are protected and that the appropriate level of financial support is being provided.

Impact on Family Tax Benefit Part A

How does child support received impact the amount of Family Tax Benefit Part A?

Child support received can have an impact on the amount of Family Tax Benefit Part A that you receive.

The Australian government takes child support payments into account when determining the amount of Family Tax Benefit Part A that you’re eligible for.

The child support payments are considered as income and are taken into account when calculating your family’s adjusted taxable income.

This means that if you receive child support, it will be factored into the assessment of your Family Tax Benefit Part A entitlement.

It’s important to accurately report any child support payments you receive to ensure that your Family Tax Benefit Part A is calculated correctly.

Conclusion

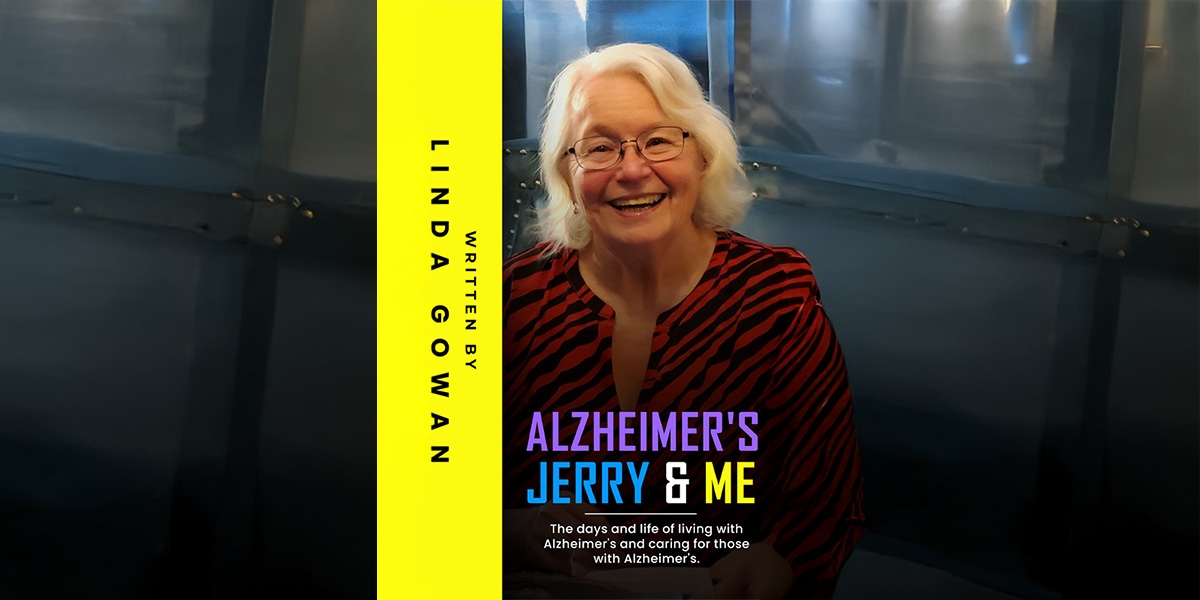

In conclusion, understanding the key requirements and impact of binding child support agreements is essential for parents going through a separation or divorce. These agreements must be in writing, include independent legal advice from an accredited Family Law firm, such as Stewart Family Law, and outline the amount of child support payments.

Both parents have obligations to provide accurate information and adhere to the agreement. Changes in circumstances or care arrangements may affect the agreement’s validity.

Obtaining a child support assessment and considering the impact on the Family Tax Benefit Part A are also important factors to consider.